Author

Admin

Published

January 9, 2026

Category

TRADEFLOW™ | WHERE MARKETS MEET STRATEGY

KSE-100 Technical Outlook – Volatility to remain high

(08-JAN-2026)

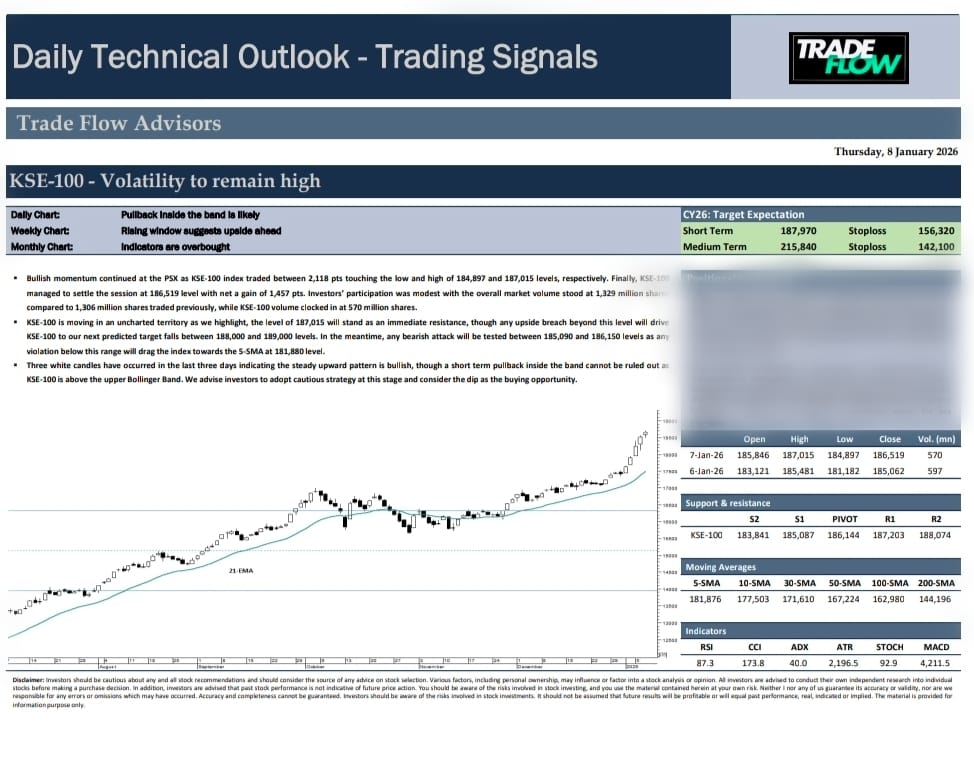

Bullish momentum continued at the PSX as KSE-100 index traded within a range of 2,118 points, touching the low and high of 184,897 and 187,015 levels respectively. Finally, KSE-100 managed to settle the session at 186,519 level with a net gain of 1,457 points. Investors’ participation was modest with the overall market volume stood at 1,329 million shares compared to 1,306 million shares traded previously, while KSE-100 volume clocked in at 570 million shares.

KSE-100 is moving in uncharted territory as we highlighted. The level of 187,015 will stand as an immediate resistance, though any upside breach beyond this level will drive KSE-100 to our next predicted target which falls between 188,000 and 189,000 levels. In the meantime, any bearish attack will be tested between 185,090 and 186,150 levels as any violation below this range will drag the index towards the 5-SMA at 181,880 level.

Three white candles have occurred in the last three days indicating the steady upward pattern is bullish, though a short-term pullback inside the band cannot be ruled out.

KSE-100 is above the upper Bollinger Band. We advise investors to adopt a cautious strategy at this stage and consider the dip as the buying opportunity.

TRADEFLOW RESEARCH — DAILY NOTE

www.tradeflowsignals.com/trading-signals

📲 WhatsApp: 0331-2020902

Follow the Tradeflow Official channel on WhatsApp: https://whatsapp.com/channel/0029VbBlsFCHQbS689LRhs2w.

Focus Stocks:

✅ DGKC | ✅ MLCF | ✅ CHCC | ✅MARI | ✅ ATRL

As of 08, January, 2026

#PSX #KSE100 #STOCKS #PAKISTAN #FFC #OGDC #AIRLINK #NBP #MCB

Tags :