Author

Admin

Published

November 5, 2025

Category

05, November 2025

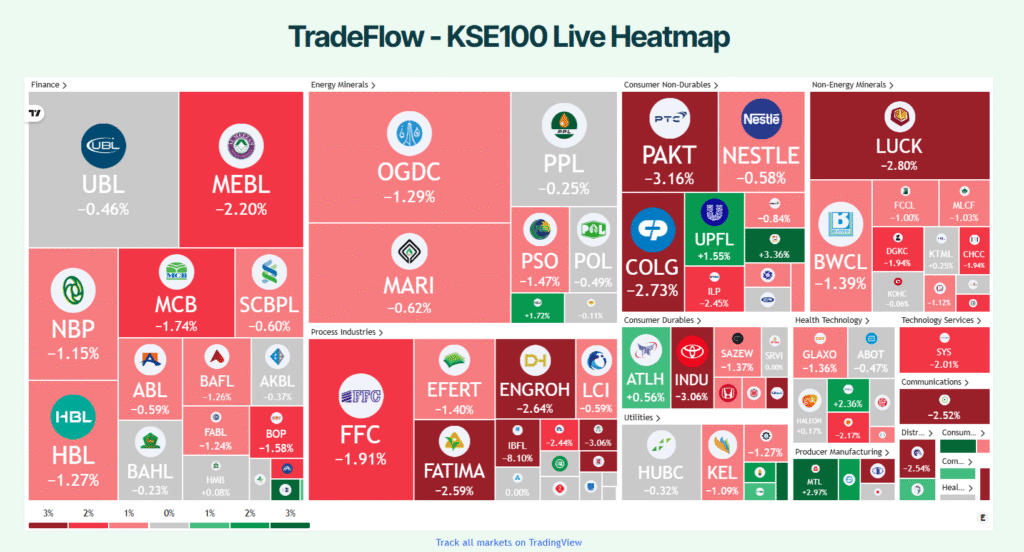

Stocks in Pakistan’s equity market extended losses Tuesday, with the KSE-100 Index sliding 1,704 points to close at 159,578, as investors remained on edge over mounting geopolitical tensions and a renewed wave of profit-taking following last week’s pullback.

The benchmark gauge briefly plunged nearly 2,000 points intraday, marking one of the sharpest corrections in recent weeks. Cyclical plays led the decline, particularly in energy, cement, and banking names, as traders trimmed exposure amid global risk aversion.

Market breadth stayed weak, with volumes hovering around 333 million shares on the KSE-100 and 859 million across the broader market — signaling a lack of conviction ahead of clarity on the macroeconomic and regional fronts.

Despite the selloff, analysts pointed to selective optimism tied to Pakistan’s Blue Economy drive, a long-term initiative projected to unlock USD 100 billion in potential by 2047.

“Investors are de-risking for now, but value is quietly building under the surface,” said one Karachi-based portfolio manager. “The focus is shifting to fundamentally strong counters that can ride out volatility.”

With sentiment fragile, traders expect headline-driven swings to persist. For now, the tone stays cautious — but bargain hunters may soon find opportunity in the rubble.

Tags :